boulder co sales tax vehicle

BOULDER COUNTY SALES TAX TAX DISTRICT RATES Boulder County collects sales tax at the rate of 0985 on all retail transacons in addion to any applicable city and state taxes. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax.

2550 Balsam Dr Boulder Co 80304 4 Beds 3 5 Baths House Prices Guest Bedrooms Bouldering

Any retail sale that is made in Boulder County is subject to county taxaon.

. Colorado collects a 29 state sales tax rate on the purchase of all vehicles. Boulder County does not issue licenses for sales tax as it is collected by the. Please see our.

The current total local sales tax rate in Boulder CO is 4985. Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales Tax Rate is 0985 for 2020. The December 2020 total local sales tax rate was 8845.

Air Care Colorado or at a Boulder County Motor Vehicles location at the time of registration cost is 20. 2055 lower than the maximum sales tax in CO. The Colorado sales tax rate is currently.

Motor Vehicles 1 Revised November 2021 Motor vehicles are tangible personal property and are therefore subject to Colorado sales and use taxes. The Boulder County Motor Vehicle Division is the branch of the Clerk and Recorders office that certifies motor vehicle titles and registrations and acts as a division of the Colorado State. Manufactured home dealers are generally.

The maximum tax that can be owed is 525 dollars. And current registration from your previously owned vehicle with you when registering your new vehicle. The County sales tax rate is.

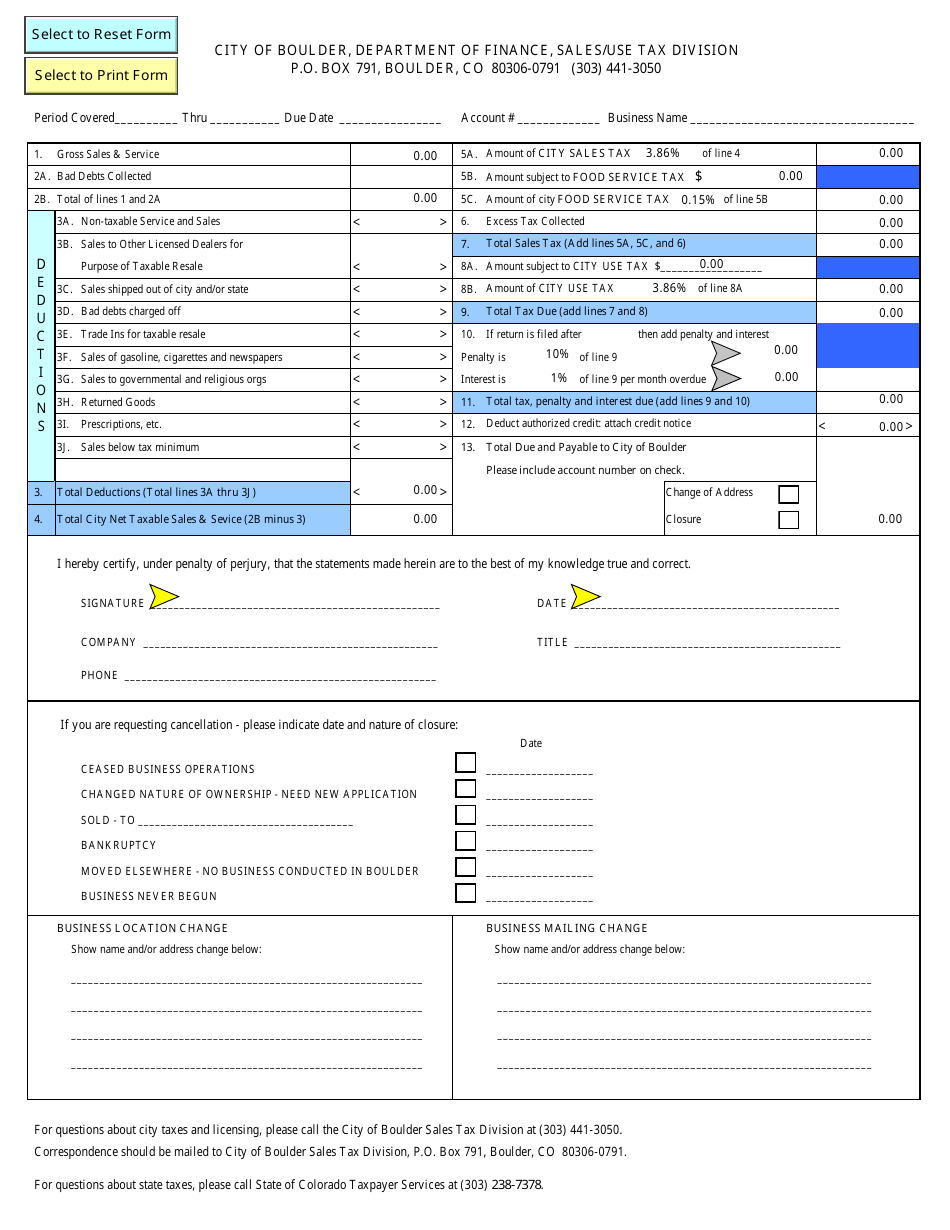

The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. Please contact your County Motor Vehicle office for the most up-to-date information.

This tax must be collected in addition to any applicable city and state taxes. Salestaxbouldercoloradogov o llamarnos a 303-441-4425. The current total local sales tax rate in Boulder CO is 4985.

Trying to decode the Boulder county motor vehicle fees and taxes and the Colorado DMV website. Manufactured homes in Colorado but not other forms of prefabricated housing must be titled with the Colorado Department of Revenue. Boulder county sales tax RTD and SCFD sales taxes.

Sale Use Tax Topics. Adams Alamosa Arapahoe Archuleta Baca Boulder. The current total local sales tax rate in Boulder County CO is 4985.

Boulder CO Sales Tax Rate. Colorado collects a 29 state sales tax rate on the purchase of all vehicles. Boulder County CO Sales Tax Rate.

Motor Vehicles 1 Revised November 2021 Motor vehicles are tangible personal property and are therefore subject to Colorado sales and use taxes. Vehicles purchased outside of Colorado Motor vehicle sales made outside of Colorado are not subject to Colorado sales tax. About City of Boulders Sales and Use Tax.

Boulder County does not issue licenses for sales tax as the county sales tax is collected by the Colorado Department of Revenue CDOR. Interactive Tax Map Unlimited Use. All applicable sales andor use taxes must be paid before the Department or any county clerk acting as the Departments authorized agent may issue a certificate of title.

Para asistencia en español favor de mandarnos un email a. The December 2020 total local sales tax rate was 8845. However special rules apply to the taxation of motor.

The Boulder sales tax rate is. Payment Sales tax and other fees will be collected by our office at the time of registration. These taxes are based on the year of manufacture of the vehicle and the original taxable value which is determined when the vehicle is new and does not change throughout the life of the vehicle.

Sales tax is due on all retail transactions in addition to any applicable city and state taxes. This is the total of state county and city sales tax rates. If you buy a new car in Boulder is it taxed at the whopping 8845 rate including Boulder city tax.

Ad Lookup Sales Tax Rates For Free. The December 2020 total local sales tax rate was also 4985. The Boulder sales tax rate is.

The Colorado state sales tax rate is currently 29. The minimum combined 2022 sales tax rate for Boulder Colorado is. This is the total of state county and city sales tax rates.

Boulder Commissioners consider sales tax for fire mitigationemergency services.

Boulder Cost Of Living Boulder Co Living Expenses Guide

Getting Your Business Established In Boulder Colorado

Sales And Use Tax City Of Boulder

New Honda For Sale In Boulder Co Fisher Honda

77 Used Cars In Stock Boulder Di Target City 1 Fisher Auto

12 Telltale Signs You Re From Boulder

Renters Swarming Colorado Mountain City At 6th Highest Rate In Nation Newsbreak

Boulder Is Proposing A New Climate Tax That Shifts More Of The Cost To Local Businesses Colorado Public Radio

Find Your Used Cars Trucks Suvs In Boulder Co Flatirons Subaru

Boulder Skyline Art Print Boulder Decor Colorado Flatirons Etsy

Moving To Boulder Boulder Co Relocation Homebuyer Guide

Boulder Taxes And Fees For New Vehicle Purchase R Boulder

Taotao Boulder B1 110cc Small Kids Atv Air Cooled 4 Stroke 1 Cylinder Automatic

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Innovation Technology City Of Boulder

.jpg;w=960)

Boulder County Looks At Future Of Transportation Sales Tax The Longmont Leader

Boulder Neighborhood Built For Public Transit Could Lose Its Buses